Undergraduate

Undergraduate (Global)

Postgraduate

PGP in Technology and Business Management

PGP in Technology & Business Management

(Young Leaders Cohort)

PGP in Human Resources & Organisation Strategy

PGP in Sports Management & Gaming

PGP in Applied AI & Agentic Systems

PGP in UI/UX & Product Design

PGP in Sustainability & Business Management

PGP Bharat

Executive

Family Business

Careers

Innovations

Faculty

MU Ventures

Enterprise L&D

Student Life

Jobs

Become a Master

events

For Companies

Blog

Get In Touch

Download Programme Brochure

Please Check the input

Please Enter Valid Email

Please Enter Valid Number

Please check the input

Inside the Markets with

Bloomberg Equity

Research Programme

A hands-on Bloomberg-powered programme designed to help you analyse markets,

build

research workflows, and

apply financial insights using live data.

Bloomberg

Equity Research

Programme

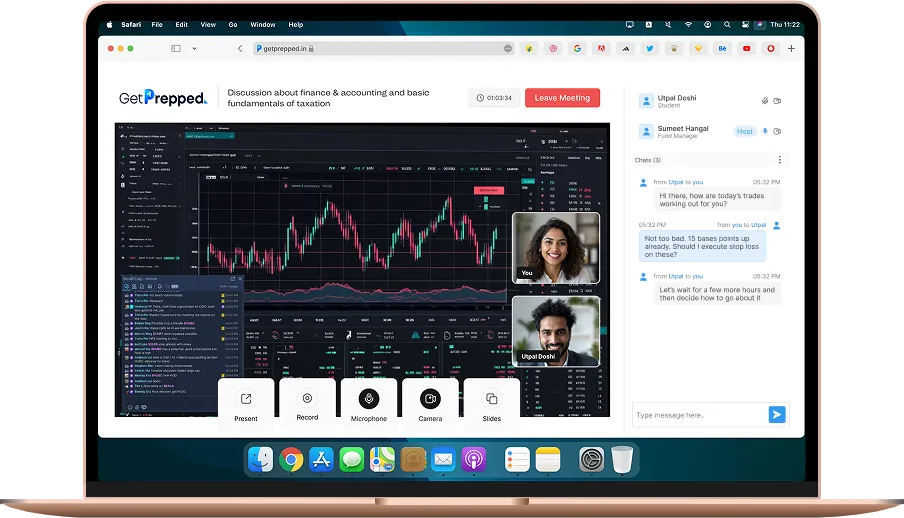

Format

Hybrid

12 months | Core Theory (once per month)

24 months | Dedicated

lab access

Commencement Date

April'26

Core Theory Sessions - April ‘26

Lab Access - Immediate

Designed For

Investors

Traders, Brokers, Analysts &

Asset Managers

Duration

12 Months

12 Months | Core Theory

24 Months | Lab Access

Designed For

Professionals Seeking Practical

Market and Bloomberg Expertise

24-Month Bloomberg Lab Access

Live market analysis, research, and applied learning

Expert-Led Bloomberg Webinars

Monthly webinars for 12 months to build Bloomberg & market proficiency

Monthly Mentor Union Access

With industry experts aligned to your interests

Academic & Market Research Access

Use Bloomberg for academic research, industry analysis, and live market study

24-Month Bloomberg Lab Access

Live market analysis, research, and applied learning

Expert-Led Bloomberg Webinars

Monthly webinars for 12 months to build Bloomberg & market proficiency

Monthly Mentor Union Access

With industry experts aligned to your interests

Academic & Market Research Access

Use Bloomberg for academic research, industry analysis, and live market study

24-Month Bloomberg Lab Access

Live market analysis, research, and applied learning

Expert-Led Bloomberg Webinars

Monthly webinars for 12 months to build Bloomberg & market proficiency

Monthly Mentor Union Access

With industry experts aligned to your interests

Academic & Market Research Access

Use Bloomberg for academic research, industry analysis, and live market study

Operate as an

Institutional

Investor:

Build theses, assess

risk,

read markets like

pros

Map Markets in Real-

time: Link

prices to news,

fundamentals,

flows,

and

macro drivers,

instantly

Industry-Grade Research

on

Bloomberg: Company,

sector,

and economic

analysis using

professional workflows

Masters’ Union

Bloomberg Lab

Unlimited 24/7 access to Bloomberg

Terminals

at Masters’

Union

Gurugram campus For 2 years

DLF Cyberpark, Gurugram

Creator Lab

at Masters’ Union

Operate like a

Professional

Creator:

Plan, produce, and

scale

content with expert tools

End-to-end Creator

Workflows:

From ideation

to publishing with

professional systems

Industry-grade Infrastructure:

Podcasting, media

production,

and

storytelling support

Unlimited access to our Podcast &

Creator Ecosystem

Access to closed-door

Power

Conversations

Unlimited access to closed-door conversations with business leaders, policymakers, and public figures.

Kishore Biyani

Ronnie Screwvala

Kiren Rijiju

Kunal Bahl

Nitin Gadkari

Train Like a

Market Professional

Each term mirrors a real finance role, with live Bloomberg workflows & outcome- driven learning.

Foundations of Bloomberg Navigation

Market Data Extraction and Integrity

Firm-Level Financial Research

Macroeconomic and Policy Intelligence

Fixed Income and Interest Rate Analytics

Research Integration with Excel

News, Events, and Market Reactions

Sectoral and Industry Analysis

Global Markets and Cross Asset Linkages

Event-Based Financial Research

Monitoring, Dashboards, and Market Tracking

End-to-End Bloomberg Research Workflow

Foundations of Bloomberg Navigation

Market Data Extraction and Integrity

Firm-Level Financial Research

Macroeconomic and Policy Intelligence

Fixed Income and Interest Rate Analytics

Research Integration with Excel

News, Events, and Market Reactions

Sectoral and Industry Analysis

Global Markets and Cross Asset Linkages

Event-Based Financial Research

Monitoring, Dashboards, and Market Tracking

End-to-End Bloomberg Research Workflow

How to Navigate Bloomberg Like a Practitioner

How to understand Bloomberg’s command structure and navigation logic

How to move across functions efficiently without trial and error

How to organise screens and save workspaces for repeated use

How to Extract Equity and Index Data for Research

How to extract historical price and volume data for Indian equities and indices

How to select correct time periods and frequencies

How to handle corporate actions and adjusted prices

How to Use Bloomberg Excel Add-In for Market Analysis

How to pull Bloomberg data into Excel

How to structure sheets for prices and returns

How to manage live versus static data responsibly

How to Use Bloomberg for Equity and Firm Level Research

How to extract firm-level financial statements and ratios

How to standardise financial data across companies

How to build peer comparisons for Indian listed firms

How to Compare Sectors and Identify Market Leaders

How to work with sector indices and classifications

How to compare sector performance across cycles

How to identify sector leaders using Bloomberg metrics

How to Track Macroeconomic Signals That Move Markets

How to access Indian macroeconomic indicators

How to track RBI policy decisions and economic calendars

How to interpret macro trends alongside market movements

How to Analyse Fixed Income Markets Using Bloomberg

How to access Indian government bond yields and benchmarks

How to read yield curves, spreads, and term structures

How to interpret rate expectations and policy transmission

How to Link Commodities, FX, and Indian Markets

How to track key commodities and currency pairs

How to analyse global-to-India transmission channels

How to interpret cross-asset correlations

How to Use Bloomberg News and Events for Market Analysis

How to track corporate announcements and macro events

How to build event timelines using Bloomberg

How to link news flow with price movements

How to Study Market Reactions Around Key Events

How to analyse price behaviour before and after events

How to define clean observation windows

How to compare outcomes across multiple events

How to Build Research Ready Dashboards on Bloomberg

How to create dashboards to track multiple assets

How to monitor indicators across markets and time

How to customise dashboards for daily market use

How to Use ESG Signals for Market and Risk Insights

How to access ESG scores, disclosures, and risk indicators

How to compare ESG metrics across firms and sectors

How to interpret ESG signals alongside market performance

Disclaimer: The curriculum is indicative and subject to ongoing refinements based on inputs from industry experts.

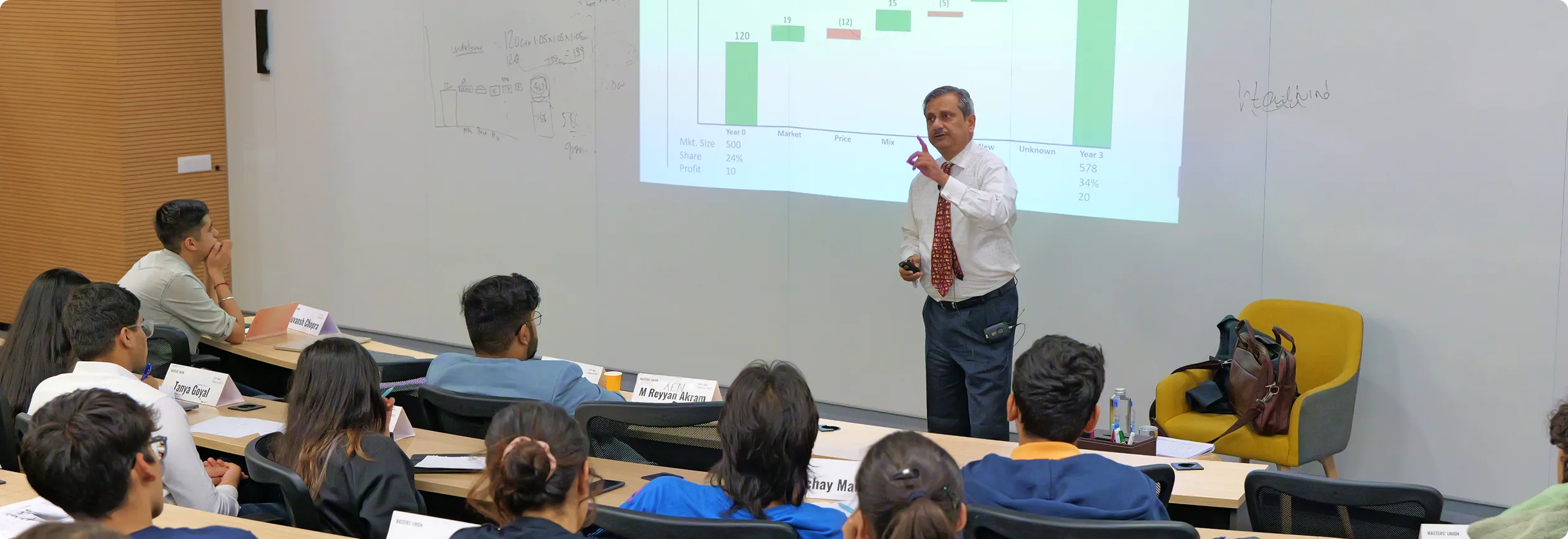

Taught by

Market

Practitioners

Learn directly from practitioners across trading, equity research, banking, and capital markets, with structured mentorship.

Neeraj Gupta

Corporate Trainer

Sudhanshu Kanwar

Former VP, Global Banking & Markets

Kunal Bothra

Consultant, Market Expert

Himanshu Arora

Visiting Faculty

Rahul Khetawat

Former SVP

Rakesh Nair

Head of Academics & Delivery

Chilukuri Vajaya Kumar

Market Trainer

Paramjeet Singh Chopra

Former Executive Director

Vaibhav Jain

Partner, Investments

Sanjeev Bhasin

Former Director

Disclaimer: *The final list of masters may vary depending on their availability and programme requirements.

Trade with Our Expert Community

Become a part of our deeply engaged trading community consisting of fellow traders, teachers & experts.

Get feedback on trades before executing

Get real-time insights on markets from industry experts

Make faster & more confident decisions on your daily trades

“What are derivatives?”

“How to select stocks?”

“How do I hedge risks ?”

Key Outcomes After Completion

-

1

Build real Bloomberg fluency through hands-on market and data workflows

-

2

Work with live, multi-asset market data to strengthen research credibility

-

3

Apply Bloomberg to analysis, research, and industry use cases- not just navigation

-

4

Learn via expert-led sessions and structured mentor interactions

Fee Structure

| Rounds |

Programme Fee |

Total |

|---|---|---|

| 1 | INR 9,00,000/- | INR 9,00,000/- |

Disclaimer: The Bloomberg Equity Research Programme by Masters’ Union is for educational purposes only and does not provide stock tips, trading calls, or investment recommendations. Any views shared by instructors, speakers, or participants are their own and do not represent Masters’ Union. Participants should do their own research, seek SEBI-registered financial advice, and comply with SEBI regulations before making any financial decisions. Masters’ Union assumes no liability for any financial actions taken.

Get in Touch

Speak to an Admissions Advisor

Mobile no.

Working hours

Mon to Sat, 11 AM - 7 PM IST

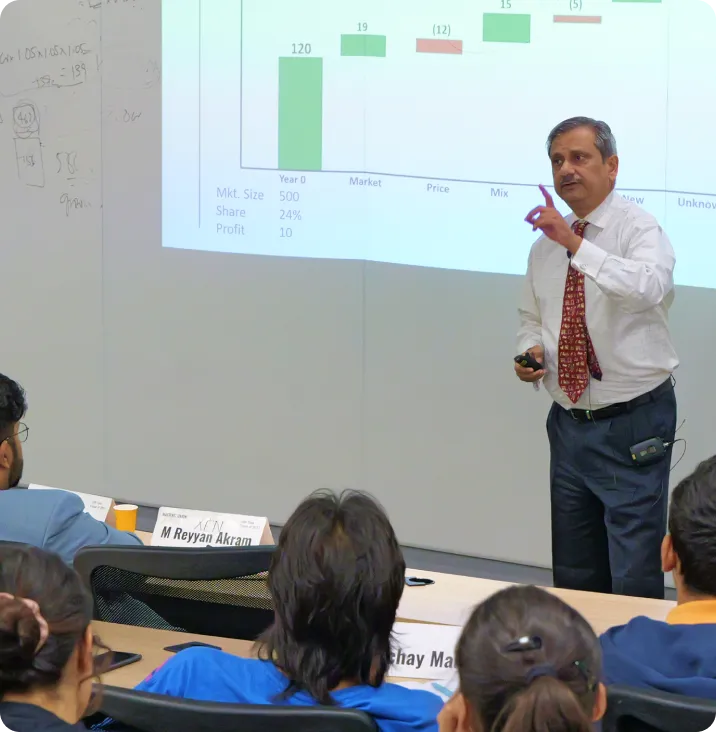

World-Class Campus in the

Heart

of

Gurugram

Book a Campus Tour